Arizona Becoming Hub for AI-Powered Law Firms Under New Ownership Rules

Arizona opened a door in 2021 that technology companies had been waiting decades to walk through: the right to own and operate law firms. The transformation came quickly. KPMG Law US became the first Big Four firm to practice law in the U.S. AI startup Eudia raised over $100 million to automate M&A due diligence. More than 100 tech-enabled firms now operate under Arizona’s Alternative Business Structure program, creating a laboratory for how artificial intelligence will reshape legal services.

Arizona’s Regulatory Experiment: From Pilot to Model

When the Arizona Supreme Court adopted its Alternative Business Structure framework in 2021, it triggered one of the most consequential shifts in the modern history of U.S. legal services. The new system licenses Alternative Business Structures, entities where lawyers, technologists, and investors can jointly deliver legal work under ethical oversight. Each ABS must appoint a compliance lawyer and submit to continuous review by the state’s Committee on Alternative Business Structures, which monitors consumer protection and professional integrity. The aim is not deregulation but modernization: expanding legal capacity while maintaining accountability.

Early ABS approvals focused on estate planning, tax, and compliance services. By 2025, the roster had grown to 136 approved entities as of April 2025, including hybrid firms integrating machine learning systems for contract drafting, document triage, and client intake. Arizona’s model, once viewed as a niche pilot, now shapes national and international debates on how law should adapt to automation. Researchers analyzing ABS performance have noted that the framework incentivizes both efficiency and experimentation without abandoning professional standards, creating a uniquely transparent test case for AI-assisted law practice.

Why AI Changes Everything for Legal Services

Artificial intelligence is redefining what counts as legal labor. Document review that once consumed weeks can now be completed in hours using supervised learning models. Predictive analytics assess litigation outcomes, while large language systems assist with research and drafting. In conventional firms, investment in such tools is limited by ownership and capital restrictions. Under Arizona’s ABS regime, however, entities can integrate legal and technical expertise within a single corporate structure, enabling direct development of proprietary AI infrastructure rather than outsourcing it.

This integrated model accelerates innovation but complicates oversight. Algorithms now participate in decision-making processes once reserved for human associates. To address that reality, Arizona requires each ABS to document how AI outputs are reviewed, validated, and disclosed to clients. The system borrows concepts from emerging international frameworks on AI accountability, where transparency, human control, and data integrity are treated as measurable compliance objectives. These obligations ensure that efficiency gains do not eclipse ethical responsibility.

How AI-Augmented Law Firms Actually Operate

ABS firms in Arizona now operate with varying degrees of automation. A prominent example is Eudia Counsel, which launched in September 2025 as an AI-augmented law firm approved under the ABS program. The firm uses proprietary AI technology combined with human legal expertise to accelerate M&A due diligence by instantly analyzing thousands of documents, identifying key risks, and generating dynamic issues lists. Eudia’s platform includes what the company calls a “Company Brain,” a proprietary intelligence system that captures strategic context, legal preferences, and institutional knowledge with each engagement.

Similarly, KPMG Law US became the first Big Four accounting firm to receive ABS approval in Feb. 2025. The firm focuses on high-volume, process-driven legal work such as contract management, compliance services, and post-merger integration of legal contracts and technology systems. By combining cutting-edge artificial intelligence with legal services, KPMG aims to offer technology-enabled solutions at scale that complement rather than replace traditional law firm services.

These systems are less about replacing lawyers than about translating legal work into data-driven processes that clients can understand. Some firms deploy predictive tools to assess regulatory exposure or manage portfolio risk. Several have adopted client-facing dashboards that track progress and visualize cost allocation in real time, integrating workflow transparency directly into service delivery.

In practice, AI integration allows pricing models that break from the billable hour. Subscription and fixed-fee structures are becoming standard, supported by traceable metrics on time, accuracy, and oversight. This shift mirrors findings from Stanford’s Deborah L. Rhode Center on the Legal Profession, which reports that client satisfaction improves when firms quantify the human review involved in automated tasks. The Arizona experiment thus doubles as a behavioral study in transparency: automation becomes a trust mechanism rather than a threat.

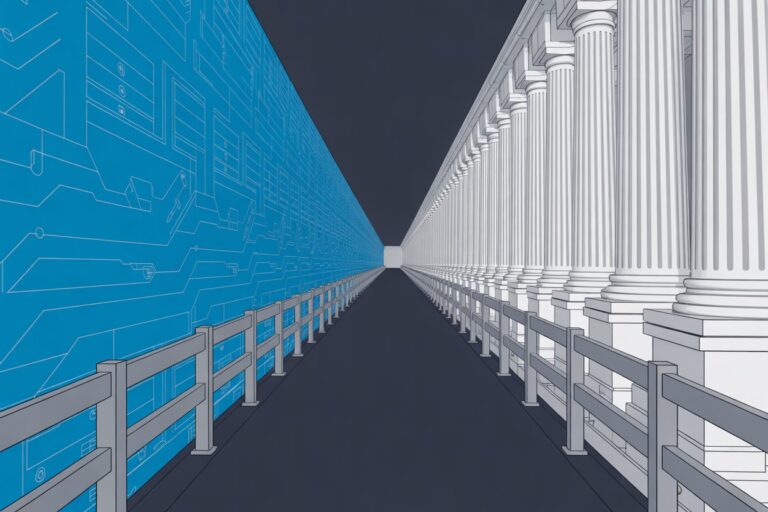

Comparisons with Utah and England

Utah remains Arizona’s closest domestic counterpart. Its regulatory sandbox, launched in August 2020, authorizes experimental legal-service entities under time-limited supervision. Participants must submit regular data on client outcomes, consumer complaints, and economic impact. AI-assisted document platforms and automated compliance tools feature prominently in the Utah program, offering a glimpse of how nontraditional structures can expand affordable service delivery. Yet Utah’s approach remains provisional, with the sandbox set to expire in 2027 pending further evaluation.

By contrast, Arizona’s system is permanent and self-sustaining. It has established a licensing pipeline and compliance architecture comparable to the Legal Services Act 2007 regime in England and Wales, which introduced licensed bodies in 2007. The British experience demonstrates both opportunity and consolidation. Early flexibility fostered rapid technology adoption and multidisciplinary firms, but it also concentrated market power among global providers. Arizona regulators are mindful of that precedent as venture-backed AI platforms enter the field.

Ethical Oversight and Professional Judgment

Arizona’s rules treat ethical supervision as an operational requirement, not an abstract duty. Every ABS must appoint a compliance lawyer responsible for enforcing the state’s professional-conduct standards, reporting violations, and ensuring client communication about technology use. This structure aligns with global trends toward codified AI governance frameworks, where disclosure, documentation, and human accountability are built into the regulatory fabric. The emphasis reflects principles outlined in the Legal Services Board’s innovation monitoring program in the UK and the OECD’s AI Principles, which were updated in May 2024 to address emerging challenges with enhanced focus on safety, privacy, and information integrity.

The rule of thumb remains constant: lawyers may automate processes but not judgment. Ethical competence now includes the ability to understand and explain how AI influences a legal outcome. As academics have noted in studies of digital-era professional ethics, this standard does not lower expectations, it raises them. Automation removes the margin for ambiguity, requiring clearer lines of reasoning and review. In that sense, Arizona’s model reframes the lawyer’s role from laborer to verifier, preserving the essence of professional judgment in a data-defined environment.

Economic Pressures and Access to Justice

Supporters of Arizona’s reform argue that the ABS model opens paths to legal access that traditional firms could not sustain. By allowing outside investment, these entities can fund development of automated tools for consumers and small businesses: tenant-rights apps, debt-relief advisors, and limited-scope document services supervised by licensed lawyers. The approach draws on empirical work showing that technology-based delivery systems can narrow justice gaps when paired with clear professional oversight. Arizona’s regulators report that early ABS entrants have increased service availability in rural and moderate-income regions without measurable declines in quality.

Critics counter that AI-enabled efficiency may eventually privilege scale over ethics. Automated intake and triage tools can amplify bias if they learn from incomplete or skewed data, and investor pressure could distort professional incentives. To mitigate these risks, Arizona mandates transparency about AI-assisted processes and public reporting of consumer complaints. This mirrors best practices identified in comparative studies of regulatory innovation, which emphasize iterative monitoring rather than static rulemaking. The goal is adaptive governance: frameworks that evolve alongside the systems they oversee.

Insurance and Risk Management

As AI becomes embedded in client work, professional liability insurers are revising how they assess exposure. According to data compiled by the National Association of Insurance Commissioners, underwriting models now consider whether firms maintain written AI oversight policies, document human review of automated outputs, and perform vendor due diligence. Carriers are beginning to treat algorithmic governance as a component of professional competence. Firms that can demonstrate traceability and auditability in their workflows are rewarded with better renewal terms.

Flat-fee and subscription pricing reduce billing disputes but do not eliminate liability. Negligence or data-handling failures still raise coverage questions unless human supervision is clearly documented. Recent insurer guidance reflects a growing consensus that risk follows decision-making authority: AI may assist, but humans remain accountable. The insurance market’s shift reinforces Arizona’s premise that modernization requires ethical responsibility rather than replacing it. Over time, compliance reporting for ABS firms could resemble the structured assurance systems already used in financial technology and healthcare.

The Investor Dimension

Opening ownership to non-lawyers has drawn interest from technology investors and global consulting firms seeking footholds in the U.S. legal market. Venture capital sees Arizona’s framework as a way to integrate software and legal service under one regulated roof. Eudia, for example, raised over $100 million in venture funding, demonstrating investor confidence in AI-enabled legal service models. Several ABS applicants have backgrounds in document automation, workflow analytics, and predictive compliance, reflecting a convergence of law and data science. Observers note that this structure effectively turns licensed firms into hybrid technology companies, subject to legal ethics but also capable of scaling like startups.

Still, investment comes with guardrails. Arizona’s regulations prevent owners from influencing legal judgment or fee arrangements, preserving attorney independence. Each ABS must designate a compliance lawyer with authority to veto business decisions that threaten ethical standards. This dual structure of capital and conscience may determine whether AI-driven firms can expand without provoking regulatory backlash. Comparative research on England’s post-2007 market shows that long-term success depends less on deregulation and more on building credible systems of internal accountability.

International Standards and Comparative Momentum

Beyond Arizona, legal regulators worldwide are converging on similar questions: how to reconcile innovation with oversight, and how to measure professional accountability in an algorithmic environment. The OECD’s AI Principles, updated in May 2024, and the Legal Advice Clinic at London South Bank University both emphasize transparency and human-in-the-loop systems as the foundation for trustworthy deployment. In Europe, the AI Act now sets enforceable transparency obligations for professional services, influencing global standards for disclosure and documentation.

Arizona’s approach, though limited in geographic scope, aligns with these principles. Its compliance-officer model mirrors governance mechanisms in the financial sector, where designated accountability roles have long existed to oversee algorithmic risk. Comparative analysis from the University of New South Wales Law Journal argues that such integration points, linking engineering oversight to legal ethics, will become the default for professional AI regulation. In effect, Arizona has preemptively created the compliance infrastructure that other jurisdictions will soon require.

Lessons for the Legal Profession

Arizona’s Alternative Business Structures program represents a measured response to a technological inevitability. It expands who can build and finance law firms while retaining strict ethical controls. The state’s regulators have positioned AI not as a disruptive threat but as a managed tool, governed through continuous reporting, human accountability, and transparent ownership. That framework may prove more durable than resistance-based approaches, which risk leaving innovation to unregulated actors outside the legal system entirely.

For now, Arizona offers a working prototype of what a 21st-century law firm might look like: multidisciplinary, technology enabled, and ethically supervised. Whether other states follow will depend on measurable results such as client trust, complaint records, and access to services rather than ideology. As with all innovation in law, the decisive factor will not be the speed of AI’s evolution but the profession’s ability to adapt its judgment to match it.

Sources

- American Bar Association: Formal Opinion 499, “Passive Investment in Alternative Business Structures,” (Sept. 28, 2021)

- Annual Review of Law and Social Science: “Access to Justice and Technology Innovation” (Sandefur, 2022)

- Arizona Law Review: “Comparing Washington, D.C.’s Rule 5.4 With Arizona’s Rule 5.4 Abolition” (March 2023)

- Arizona Supreme Court: Committee on Alternative Business Structures (2025)

- Arizona Supreme Court: ABS Committee Annual Report (April 2025)

- Artificial Lawyer: “Eudia Opens ‘AI-Augmented Law Firm’ For M&A” (September 2025)

- European Commission: Regulatory Framework on Artificial Intelligence (2025)

- LawSites: “KPMG Becomes First of Big Four To Practice Law in U.S.” (February 2025)

- Legal Services Board (UK): Innovation Monitoring Program (2025)

- Legal Services Board (UK): Legal Services Act 2007 Overview (2025)

- National Association of Insurance Commissioners: AI in Professional Liability (2025)

- Organisation for Economic Co-operation and Development: AI Principles (Updated May 2024)

- PR Newswire: “Eudia Launches First AI-Augmented Law Firm” (September 2025)

- Stanford Law School Deborah L. Rhode Center on the Legal Profession: Access to Justice and Innovation (2025)

- Stanford Law School Legal Aggregate: “Regulatory Innovation at the Crossroads: Five Years of Data on Entity-Regulation Reform in Arizona and Utah” (June 2025)

- Utah Office of Legal Services Innovation – Regulatory Sandbox (2025)

- Utah Supreme Court: Regulatory Reform Committee Materials (May 2025)

This article was prepared for educational and informational purposes only. It does not constitute legal advice and should not be relied upon as such. All statutes, studies, and sources cited are publicly available through official publications and reputable outlets. Readers should consult professional counsel for specific compliance questions related to AI use.

See also: Should AI Receive Attorney-Client Privilege or Is Every Prompt a Potential Waiver?

Jon Dykstra, LL.B., MBA, is a legal AI strategist and founder of Jurvantis.ai. He is a former practicing attorney who specializes in researching and writing about AI in law and its implementation for law firms. He helps lawyers navigate the rapid evolution of artificial intelligence in legal practice through essays, tool evaluation, strategic consulting, and full-scale A-to-Z custom implementation.